Amgen Shines As Medical Sector Benefits From Sector Rotation

Nov 21, 2025 16:22:00 -0500 by JUSTIN NIELSEN

With many of the former leaders correcting considerably, medical stocks have offered a rare bright spot. Rising relative strength lines are making it clear that money is flowing to this area with ETFs like iShares Biotech ETF (IBB) and SPDR Select Healthcare Select Sector SPDR Fund (XLV) outperforming. Amgen is the top weight in IBB according to iShares data.

It is also in the top 10 weights of the 60 holdings for XLV. ETFs offer a good way to get broad exposure but they also help target positions in the leaders.

When Low Relative Strength Ratings Shouldn’t Be Ignored

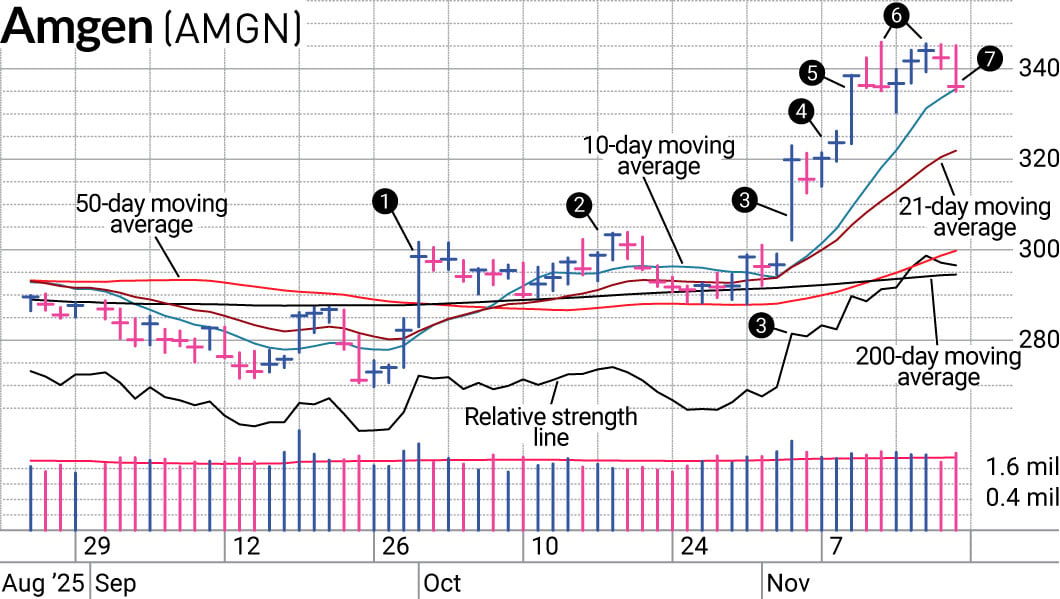

While markets have been rallying since April, a lot of the medical stocks were sitting on the sidelines. But a pharmaceutical tariff announcement by President Trump made a big impact on Big Pharma stocks. Amgen (AMGN) jumped nearly 6% on the announcement crossing above its 50- and 200-day moving average lines (1).

After getting knocked back by resistance around 300 (2), Amgen stock consolidated its gains with a Relative Strength Rating hovering around a dismal 30. But when stocks don’t participate in a major market rally, they can have low relative strength ratings just as they start to receive the benefit of sector rotation. Even Apple (AAPL) had a low Relative Strength Rating when it first came out of a cup with handle in 2004. The reason? It didn’t participate in the major rally in 2003.

The earnings announcement for Amgen sent it up another 7% (3) and then it consolidated its gains for the next two days. Once it broke above the highs of the earnings announcement, we added it to SwingTrader (4).

Handling Amgen Stock

One of the main problems with entries over the past few weeks is that they have no follow through. The trade either fails to launch or just fails completely and takes out stop losses. Amgen was different in that we got an immediate gain (5). As “The Big Picture” column suggested that day, the leadership complexion seemed to be changing.

However, it’s still difficult to hold onto stocks for long when a market stops trending higher and gets choppy. So when Amgen kept hitting resistance at 345, it was on the chopping block for a trim (6).

With the dramatic downside reversal on Thursday in the market indexes, we started trimming Amgen early in the day and exited completely by the end of the day (7). Though it was holding up much better than most stocks, we already had a heavy medical exposure on SwingTrader. That meant we had to sacrifice something to lower exposure and the undercut of recent lows made Amgen the logical choice. But it doesn’t seem like the medical move is over yet. It can still be a ripe sector for swing trades while we see if the broader market gets its footing.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Learn How To Time The Market With IBD’s ETF Strategy

This Model Points To Inflows In Medical ETF

Looking For The Next Stock Market Winner? Start With These 3 Steps