Biotech Stocks Returned To Health And Offered Multiple Entries

Oct 24, 2025 16:44:00 -0400 by JUSTIN NIELSEN

After peaking in February 2021, biotech stocks as a group didn’t participate once the market turned around after 2022. This summer seems to have changed that.

Biotech stocks are not easy to handle individually. The development stage cohort is filled with stocks that have no earnings and often no revenue, except for inconsistent milestone payments.

That just happens to be the majority of members in the nearly 800 stock Medical-Biomed/Biotech group. But the SPDR S&P Biotech ETF (XBI) can get you the exposure without the worry of a clinical trial or dangerous side effect of a single drug blasting your portfolio into oblivion.

Conquering The 200-day Line Starts The Journey

XBI struggled under its 200-day line for most of the year. Even when the April 22 follow-through day triggered, XBI still had 17% to go to retake the long-term trendline.

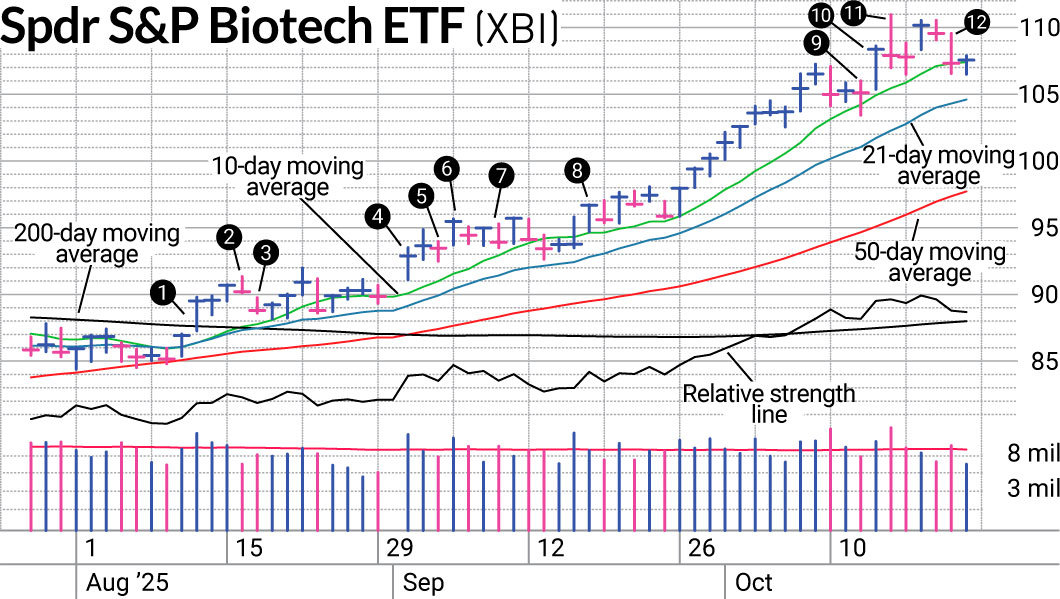

Our strategy was patience. After rising well off its bottom, XBI joined SwingTrader on Aug. 13 as it retook its 200-day line (1). As we typically do, we started trimming the position into strength in what turned out to be a downside reversal day (2). We exited the remainder the next day as we fell back below our entry price (3). But the trade still finished with over a 0.5% gain. How? The earlier sell locked in profits and helped keep the trade green instead of taking a loss.

After a couple of weeks, we gave the biotech ETF another shot as it broke above resistance (4). This time, we trimmed the position back a little early as we failed to make initial progress (5). With so many positions acting well, it was hard to stick with a position that wasn’t. However, we adjusted the next day and added the trimmed position back immediately as strength returned (6). Unfortunately, XBI went sideways again and we ended up exiting with a small loss on the trade (7). If positions don’t perform, the exits usually come quickly to keep moving where the relative strength is.

Sometimes it’s not as easy to buy back positions. When the biotech stocks started moving again (8), we were already on margin. Unfortunately, this was when XBI started to really run.

Looking For New Chances At Biotech Stocks

Just because you miss a run doesn’t mean you should swear off any future trades. An upside reversal at the 10-day line gave us another chance at the biotech stocks (9). This time, instead of taking profits into strength we leaned in bringing XBI to an oversize position the next day (10).

It was one of the few areas that were working after the Oct. 10 sell-off but we didn’t want to push our luck. We started trimming on a downside reversal (11) and exited after XBI took out the lows of the prior few days the next week (12). Now with the strength to end the week on Friday, it’s worth looking at for another try.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Learn How To Time The Market With IBD’s ETF Strategy

Getting The Proper Mindset Puts You On The Right Side Of Any Market

Looking For The Next Stock Market Winner? Start With These 3 Steps