Biotech Stocks Survive The Sector Rotation

Dec 26, 2025 16:44:00 -0500 by JUSTIN NIELSEN

One of the hardest parts of the last quarter has been the sector rotation. Sector rotation itself isn’t a bad thing but when combined with choppiness it can wreak havoc on a portfolio. However, the biotech stocks seem to not only be surviving, but thriving, too.

It can be a hard industry to profit from with so many clinical trials, FDA approvals and development stage moonshots for the individual stocks. That’s where the State Street S&P Biotech ETF (XBI) can provide a nice investment vehicle for taking advantage of the biotech stocks’ move.

Trend For Biotech Stocks Continues

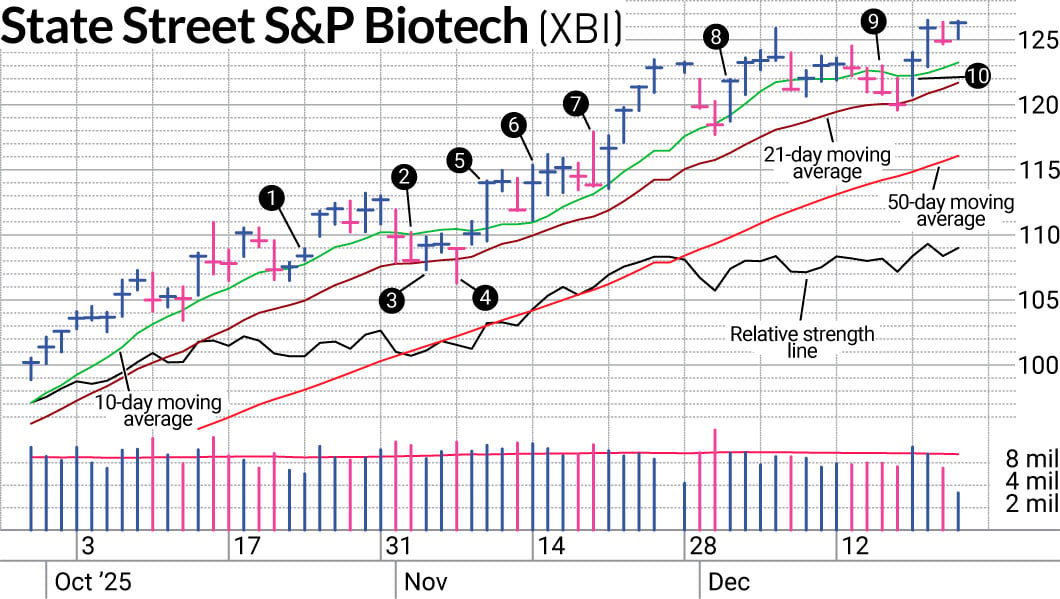

This column previously addressed a number of potential entries in XBI over the summer. The opportunities in biotech stocks were one of the few areas that trended this quarter. Not that it has been completely easy. An entry on SwingTrader on Oct. 24 didn’t pan out for us (1). We had ramped it up from a full position (starting at 10%) up to a 20% position as it gained traction. But when XBI erased a nearly 5% gain from our entry, we exited quickly to cut the loss (2).

The tough part was that XBI immediately showed an upside reversal the next day with a bounce at its 21-day line (3). It prompted another entry into the biotech stocks ETF that didn’t last. Two days later we cut the loss again as it came down to the lows of our entry day and eventually undercut that level (4). Again, the ETF showed an upside reversal by the close.

Even though XBI did trend, getting the position back proved to be difficult. But the benefit of keeping losses small is that you can try multiple times to get that foothold.

Letting A Winner Ride

That’s exactly what happened as XBI joined SwingTrader again on Nov. 11 with a 111.36 entry (5). Our entry was low enough that we were able to survive the shakeout this time and add to the position on the upside reversal (6).

Sometimes we added to the position and had to back away, even on the same day (7). But we gained flexibility with the position as we got more cushion. Even with the pullbacks to the 10-day line, our position survived and we took opportunities to add on the bounces (8).

As a swing trading product, the goal is to get as much of the quick profit as possible and then move on to the next quick profit. Trades that last longer than a month, like this one, are rare. So how do we decide it’s time to exit? When progress wanes.

When our last add was flat after a couple of weeks, we exited (9). The gain from our last trade more than made up for the losses on the previous two trades. While that trade was finished, it doesn’t mean it can’t be bought again.

In fact, a couple of days later XBI joined SwingTrader again as it bounced at its 21-day line (10). With the position already getting traction, we could be looking at another profit opportunity.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Learn How To Time The Market With IBD’s ETF Strategy

This Model Points To Inflows In Medical ETF

Looking For The Next Stock Market Winner? Start With These 3 Steps