Downside Reversal Gave Us Signal For CrowdStrike Exit

Nov 14, 2025 16:41:00 -0500 by JUSTIN NIELSEN

The market remains challenging for short-term swing trading. Upside reversals seem to be getting undercut only to turn into another upside reversal. That’s what seemed to be happening for CrowdStrike stock and a host of other growth names on Friday.

One of the ways to spot when a pullback might be imminent is to recognize short-term topping signals. As much as we love the upside reversal for buying, the downside reversal is a great tool for selling.

CrowdStrike Stock Regains Its Mojo

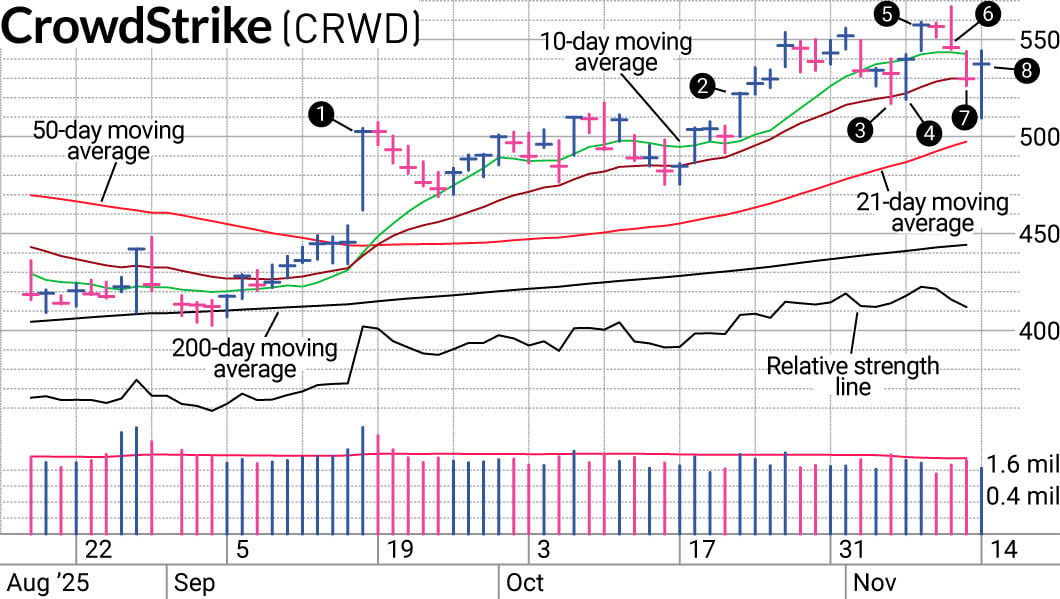

A year ago, CrowdStrike (CRWD) was punished by investors after a snafu rendered many computers useless for a few hours. Impressively, CrowdStrike stock has recovered this year. On Sept. 18, a raise in CrowdStrike 2027 guidance gave the stock price a 12.8% jump (1). Even better, it gave up very little as it consolidated over the next month before breaking out to new highs (2).

While the market indexes were struggling through October, CrowdStrike was showing a rising relative strength line and followed up on its breakout. The first week of November saw a pullback with support right at the 21-day moving average in a classic upside reversal (3). As a reminder, even a day that finishes down can still be constructive if the stock gets support and finishes up from its lows and high in its range. Even better when it’s an outside day where the high is higher than the previous day and the low is lower.

Usually the expectation after an upside reversal is that you will have the strength continue the next trading day. It happened a little differently for CrowdStrike. After falling early in the trading session it finished high in its range, cleared the previous day’s high and finished positive for the day (4). That prompted its entry as a current trade on SwingTrader.

When Trends Don’t Last

On a positive note, after our entry in CrowdStrike, we did get the follow-up we wanted (5). Weekend news suggested a deal was imminent to end the government shutdown and stocks gapped up the following Monday. It was a nice confirmation that we were on the right track. The problem was that progress stalled from there.

CrowdStrike moved to new highs but couldn’t hold the gains. Instead, we saw the evil twin of the upside reversal — the downside reversal (6). It was another outside day but the similarities ended there. This time, CrowdStrike finished well off its highs and at the bottom of its range. The expectation after such a day is for short-term weakness.

Since swing trading has a short-term focus, there is little reason to hang around and wait for the expected weakness to happen. Instead, we exited the trade. That left us with a small gain on the trade that easily would have turned negative had we waited one more day (7).

Even though Friday saw another upside reversal (8), holding through that much pain doesn’t work when you are trying to keep tight stops. As an alternative, you can always buy the stock back.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Learn How To Time The Market With IBD’s ETF Strategy

Getting The Proper Mindset Puts You On The Right Side Of Any Market

Looking For The Next Stock Market Winner? Start With These 3 Steps