GE Vernova Stock Was A Losing Trade — But Not A Bad Trade

Dec 19, 2025 17:18:00 -0500 by JUSTIN NIELSEN

Many of the leaders that started to rally back in April, are not having a good time this fall. Take GE Vernova (GEV) stock.

It’s been in a long base since August. But it started looking promising in December as it broke out from the consolidation. Unfortunately, the trade didn’t work out. But did that make it a bad trade?

The artificial intelligence theme has dominated the stock market in 2025. Megacaps like Nvidia (NVDA) might be the more obvious AI plays as their chips provide the “brains.” Alphabet (GOOGL) has led the charge on AI research with their Gemini offering exciting investors.

GE Vernova might be a little less obvious with their gas turbines. But the enormous power requirements of AI make it a solid “picks and shovels” play on the AI rush.

Where GE Vernova Made Its Move

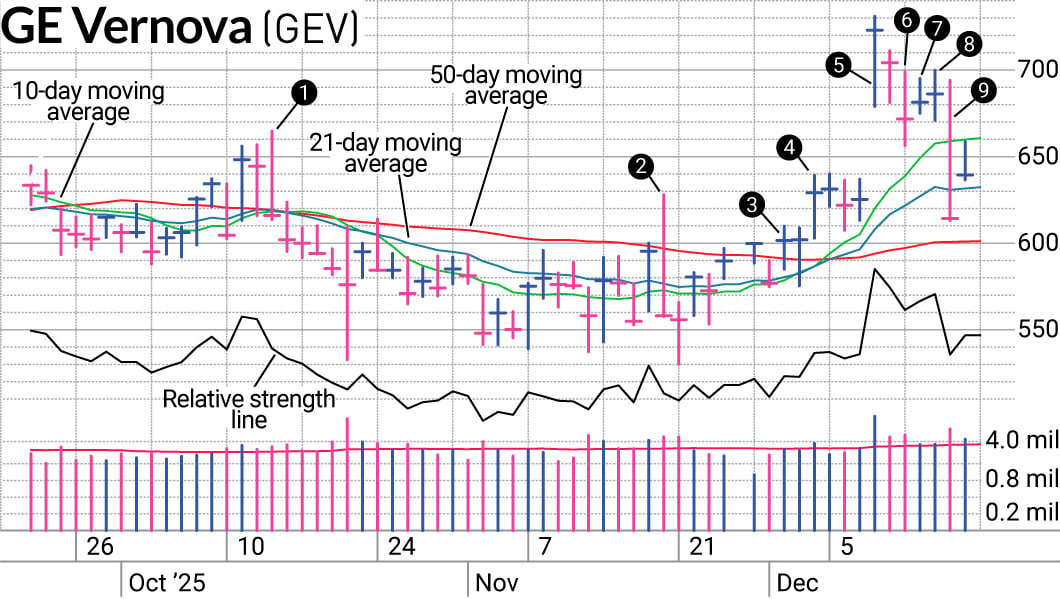

Like many AI stocks, GE Vernova took some hard hits in October (1) and November (2). But when it cleared its 50-day moving average line (3) and then took out its Nov. 20 high (4), we were looking for a chance to get back into the stock.

On Dec. 10, GE Vernova stock jumped more than 15% after announcing a triple whammy of good news (5). A big hike in its outlook, coupled with a big hike in shareholder returns with a dividend double and buyback boost, and a reported $200 billion backlog. That put it out of reach as a swing trade.

But we often look at the action after such a gap up to see how it acts. Does it immediately fall because there’s no appetite at the higher valuation? Does it spark even more buying as the news results in brighter prospects? Or does it tighten up and digest gains?

We viewed the action on GE Vernova as the latter. In fact, we tried a brief trade on Dec. 12 on the SwingTrader product when it looked like it was going to cross the 700 level (6). However, we quickly backed away when it started undercutting lows of the day and recent lows later the same day. Since it was only 2.5% of the model portfolio, the damage was minimal.

GE Vernova stabilized and we tried it again after the weekend with another 2.5% position (7). It wasn’t a great close but when we started making progress on the position, we added to it (8). With a 5% weight, a move higher can have a more meaningful impact, but its still low enough to minimize damage if things turn south.

Was GE Vernova Stock A Bad Trade?

The next day, GE Vernova started on a shaky note (9). We were already apprehensive because of the poor closes but as it got to the lows of the prior day we scaled out of our most recent add. Once the selling accelerated, we removed the remaining position as it undercut the Dec. 12 low later in the day.

From our entry, we were looking at the potential of at least a 6.5% move if GE Vernova was able to break into new high ground. As bad as the day was for our exit, our loss was only 3.7%.

If we put our money on setups where we can gain two times or more of what we risk, we can afford to be wrong a lot of times and still make money. Especially for those cases where the gains are even higher than the minimum expectation. The more you can keep the losses small, the less you have to make to have the math work in your favor.

One instance that doesn’t work favorably doesn’t make a trade bad if it can work over the long run.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Learn How To Time The Market With IBD’s ETF Strategy

This Model Points To Inflows In Medical ETF

Looking For The Next Stock Market Winner? Start With These 3 Steps