Despite A Strong Year Already, Gold Stocks Had More To Give

Dec 05, 2025 16:30:00 -0500 by JUSTIN NIELSEN

There have been a lot of entry points for gold stocks this year. But they haven’t all worked. A key element in swing trading is keeping losses small so that you have the capital to try multiple times if need be. If you look at getting more reward than you risk, a few good trades can wipe out many bad ones.

Base In Gold Stocks Give Quick Swing Trades

There are a number of ways to play moves in gold. To cut the risk of individual business and mines, we will often go with the VanEck Gold Miners ETF (GDX) when we want to play gold stocks. You get a little leverage on the movement in gold by going with the miners. Occasionally we may go with just the price of gold itself using SPDR Gold Shares (GLD) or even the leveraged version with ProShares Ultra Gold (UGL).

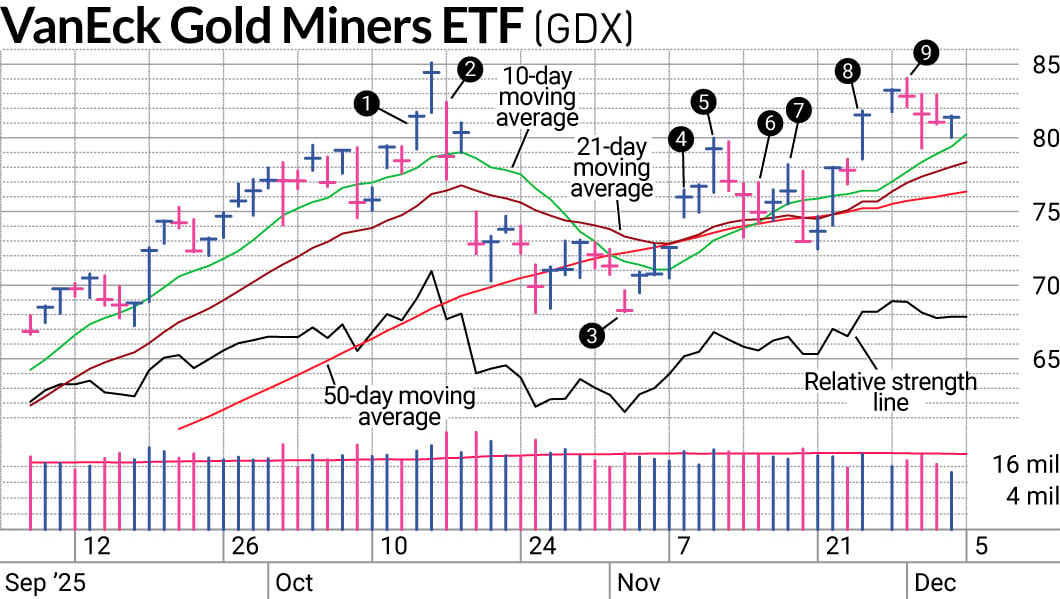

The angle of ascent for gold stocks was unusually steep this summer and very profitable. We ended up trying it again on SwingTrader in October (1) and after the trade quickly failed (2), we waited to see if the gold stocks would base. After bottoming in November (3), GDX gapped above its 50-day moving average line and joined SwingTrader again (4).

As our guide for supply and demand, the chart made it very clear that prior areas above our entry could act as resistance. Since we were still in a basing phase we started locking in profits on strength (5) and exited the GDX completely while we were still profitable (6).

Keeping Losses Small Allows You To Try Again

We’ve had over 20 trades in gold stocks this year. Of course they don’t all work. The only way to stay in the game is to make sure you cut losses quickly when a trade goes against you. If you have a run of stocks go against you, you can also start reducing position sizes to limit the losses even more.

After bouncing off the 21- and 50-day line, we entered GDX again (7). Because of our rough start to November, we were reducing our ETF positions to half positions instead of full positions.

When GDX got clobbered the next day, along with most of the market, we didn’t hesitate to exit the position. Not only did we keep the loss on the trade around 3%, but because it was a half position, the hit to the portfolio was even less.

Protecting capital gives you the freedom to take multiple shots. Just a few days later, we were back in GDX as it recovered above the 80 price level (8). Again we started with a half position, but this time we built it up since the trade was working. Letting decisions depend on market feedback can keep you in sync.

But we always shift money to where we think it will have the most potential. We started trimming this week (9) not because of any particular sell signals, but to lock in profits while we had them and free up cash for better opportunities.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Learn How To Time The Market With IBD’s ETF Strategy

This Model Points To Inflows In Medical ETF

Looking For The Next Stock Market Winner? Start With These 3 Steps