Here's Why We Exited Walmart Stock Before It Hit Its Stop

Oct 31, 2025 16:28:00 -0400 by JUSTIN NIELSEN

October felt like it had plenty of tricks as well as treats. It’s a stark reminder of why risk management is so important. While we often set stops for our maximum loss, nothing says we have to wait that long.

Once we recognized our position in Walmart wasn’t working, we exited early to make the trade flat instead of waiting for things to get worse.

Walmart Stock Offers Counter Trend

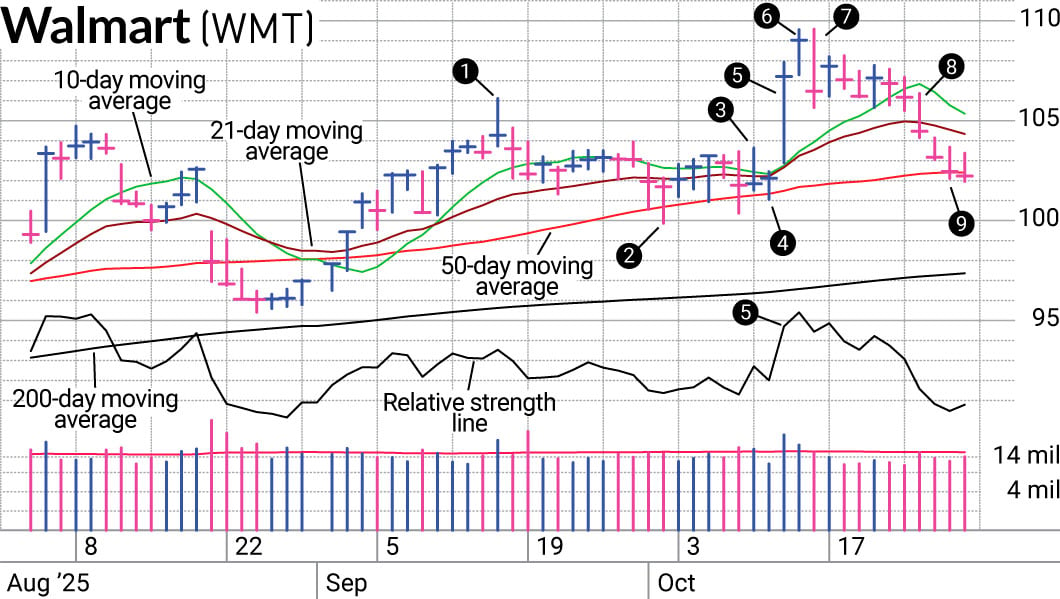

Walmart (WMT) put in a near-term top in September (1) and its relative strength line wasn’t doing great while it based. However, its overall uptrend never got broken in a big way. Instead, the 50-day moving average line offered support (2).

When markets, and most stocks, plummeted on Oct. 10, Walmart stock barely budged (3). In fact, the next day it bounced again from its 50-day line (4).

Since we were in cash after the Oct. 10 drop, Walmart seemed like a good candidate to start testing the waters. We added it to SwingTrader just as it was nearing all-time highs on what turned out to be a powerful day (5). Notably, the relative strength line looked much different as most stocks entered into a trading range. Walmart offered a lower average true range (ATR) which was an attractive quality in an uncertain market. We were still somewhat tentative and went with a half position to start with the lower risk of a low ATR stock.

Because of our desire to be conservative, when Walmart followed up with further strength the next day (6) we kept it as a half position instead of adding. It was too soon to declare ourselves out of the woods with the market environment.

No Need To Wait For Things To Get Worse

Though Walmart was still far from our stop, we exited the position as it fell back to our entry (7). Based on our expectation that we were looking at a potentially sideways market for a time, we were willing to make test buys to see if we could get traction. But that meant that we would cut early to reduce our drawdown. If you keep trying multiple positions when the market is unfavorable you risk a string of losses that can do more damage than you would think. Even cutting losses quickly can end up being a sizable loss from a lot of paper cuts.

Initially, Walmart didn’t really go down after we exited. But a few days later, it crossed below its 21-day line just as growth stocks were gaining traction again (8). By the time Walmart hit our stop (9) a lot of damage was done. Even worse, it would have been taking up space for positions with better prospects.

There is certainly a place for patience, but when you recognize a turn in your stock or the market, quick action can keep you from going too far astray down the wrong road.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Learn How To Time The Market With IBD’s ETF Strategy

Getting The Proper Mindset Puts You On The Right Side Of Any Market

Looking For The Next Stock Market Winner? Start With These 3 Steps