MDB Stock Offered A Small Win In A Week Of Losses

Nov 07, 2025 16:44:00 -0500 by JUSTIN NIELSEN

As bad as October was for swing trading, November isn’t starting much better. The wins have been fewer and mostly due to taking profits quickly while you have them. That was the case for MongoDB.

MDB Stock Joins The Party

Most of the leading stocks of this rally started moving above their 50- and 200-day moving average lines around the April 22 follow-through day. But MongoDB (MDB) was on the slower side.

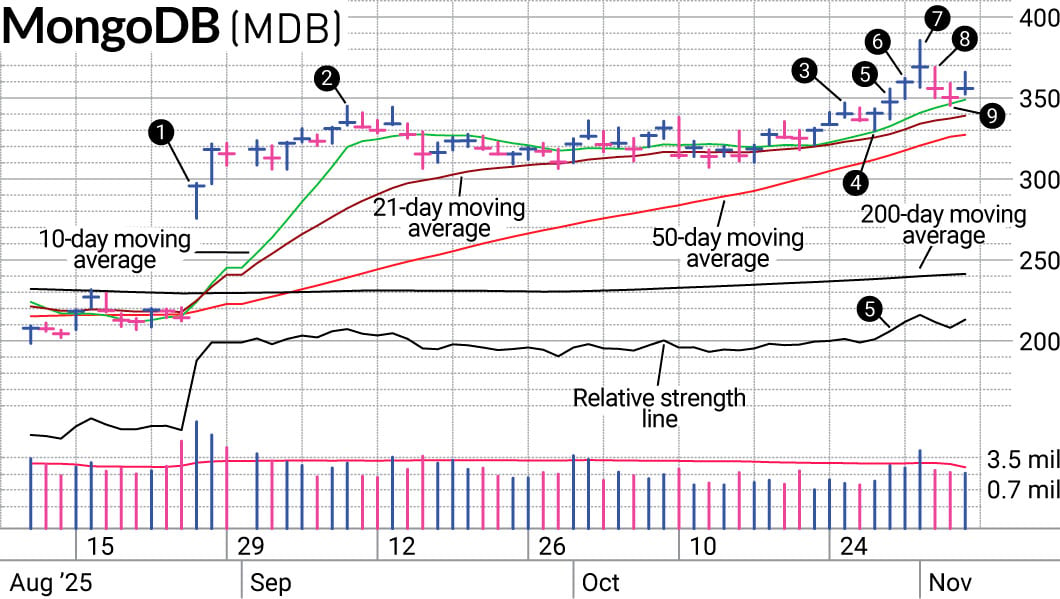

After spending most of the year below its 200-day line, MDB finally popped above the long-term moving average on its last earnings report at the end of August (1). Not only did MDB hold the nearly 40% gap-up, it added more than 15% over the next couple weeks (2). It’s a strong sign that investors were comfortable at the higher valuation.

The next six weeks saw a flat base form with only an 11% depth. The stock basically let its 21-day line catch up to it while it went sideways. After one more test at the potential buy point (3), MDB had a slight pullback and then an upside reversal (4).

MDB joined SwingTrader as a half position on the follow-up to the upside reversal and a breakout from the flat base (5). Even better, the relative strength line confirmed the strength as it got to new highs.

More Money Goes To The Best Positions

We added to MDB as it followed up on its breakout, bringing it to a full position the next day (6). But the position didn’t last long. As the month rolled to November, a strong start to stocks this past Monday faded by the close. That left a lot of stocks like MDB with a downside reversal (7). However, early that morning we were already locking in some profit on strength.

When the market took a hard hit on Tuesday, we kept the MDB position because it was holding the lows of the prior two days whereas the indexes were making serious undercuts (8).

But when MDB started undercutting its lows of the prior two days, we exited the remaining position (9). Both legs of the trade ended with profit and though it was only 2.3% for the entire trade, this week didn’t produce many winners so it was welcome. It’s still a decent gain for a week’s time especially since choppy markets are notoriously difficult to navigate.

We could have stubbornly held on and after Friday’s upside reversal we would have been better off. But without the benefit of hindsight, the reality is we would have most likely sold at a worse price. Better to cut early and keep some powder dry for the next potential rally than take too big of a hit that knocks you out of the game.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Learn How To Time The Market With IBD’s ETF Strategy

Getting The Proper Mindset Puts You On The Right Side Of Any Market

Looking For The Next Stock Market Winner? Start With These 3 Steps